Think back to the last time your client paid an invoice

What did you do with that money? Did it immediately go towards rent, a credit card payment, or your internet bill? Do you continually refresh your PayPal account, hoping to see money magically appear so that you can take care of everyday expenses? Maybe you decided to treat yo’ self because you’ve been so busy working.

In this blog post, I’ll share a strategy that has helped me deal with these inconsistencies. This strategy has given me peace of mind and a significant improvement of stability during my freelancing journey.

As full-time freelancers, we’ve all had to deal with financial inconsistencies

Maybe you charge hourly, and one week the client uses 20 hours. Then the next week, they only need 5 hours. Perhaps a client is late on a payment that you were desperately waiting on.

You’ve been so busy networking, finding clients, and doing actual work that you haven’t had a chance to sit down and figure out your budgets. You haven’t had any transactions bounce, your credit card still works, and with a glance at your bank account balance, it looks like things will be okay.

Your schedule is full and has been for months, but a new referral comes in. You take a project out of fear that you won’t be able to pay yourself if you pass. It’s not the right fit, but it’s good money, and who knows when your other work will dry up.

After talking to many freelancers, making mistakes, and testing out ideas, I’ve found a system that works.

For me, freelancing has been the most rewarding, yet simultaneously most terrifying career move I’ve ever made. I’ve had the opportunity to work with some fantastic people who have pushed me to do my best work. However, I’ve also had my fair share of sleepless nights, a healthy dose of self-doubt, and I’ve made many mistakes along the way.

When I first started, I hadn’t thought of the idea of making a consistent salary. I was jumping from project to project, hoping my clients would pay me in a timely fashion. Sometimes clients wouldn’t pay me, and I would suddenly be on the hook to work extra hours for clients who didn’t respect me or my work, only to make ends meet.

Once I discovered that giving myself a consistent monthly paycheck would give me the time and space I needed to breathe, I was all-in. After a few months of paying myself at the beginning of every month, I naturally discovered that I was able to forecast my runway. Knowing my runway meant that I was able to take breaks from client work and focus on improving my skills and increasing my value. I stopped taking on clients who weren’t a good fit, and now only work on things I’m passionate about. I control my own work schedule. Best of all, I get to work from home with my pup @goldenqueso.

Having a freelance salary is simple and effective

To summarize, having a freelance salary means giving yourself a consistent monthly paycheck — regardless of how much you actually made.

The core question to figure out here is: “How much money do I need in my bank account every month, to support the lifestyle I want to live?”

When it comes to money, many freelancers fall into the pattern of not taking control of charging what they are worth. They’ll google what their rates should be, or ask their friends what they’re charging.

Stop looking to other freelancers to set your pricing. You should know how much income you need every month and work towards making that amount. If your skillset has a price cap, look for ways to improve your skills to increase the value of your offering.

Follow these steps to calculate and start paying your freelance salary

Before we jump in, as a disclaimer, these calculations are meant to be rough estimates to help you determine your salary. I am not an accountant, so if you need advanced help with managing your finances, please seek the advice of a certified professional. These calculations worked for me, and I hope they help you as well.

First, here are few terms that will help you understand how the calculations work:

Budget: This is the amount of money you spend every month to live. This includes things you spend money on through the month like rent, transportation, utilities, health insurance, groceries, entertainment, savings, retirement, etc.

Paycheck: This is the amount of money you’d like to pay yourself as a paycheck, after taxes. We’ll add up all your budgets to determine what your paycheck should be.

Salary: This is the amount of money you need to bring in every month which includes a portion going towards taxes. It’s important to remember that as a freelancer you have to pay your own income tax. This means, when you receive a payment for $1,000, roughly 40% or $400 of that will go towards taxes. Leaving $600 cash for you.

Yearly Salary: Your Monthly Salary x 12, so you have a bigger picture of the income you need per year.

-

Calculate how much money you need every month to cover living expenses.

First, you’ll need to add up all of your budgets and expenses that you need to live every month. The number should include things like rent, car payments, groceries, health insurance, savings, retirement contributions, entertainment, funtivities, etc.

-

Don’t forget about taxes!

Now that you’ve added up all of your budgets don’t forget about taxes! For estimation purposes, I suggest adding 40%* to the number you calculated in the last step. However, you can also use our salary calculator and we’ll do the hard part for you!

*In the United States, federal income tax can range from 10-37%, and state income tax can vary from 0-14%. It all depends on your income and where you live. 40% should cover both federal and state income taxes for most folks in the United States. To learn more about the federal income tax brackets, check out this post by NerdWallet. They also have a post that breaks down the state income tax rates.

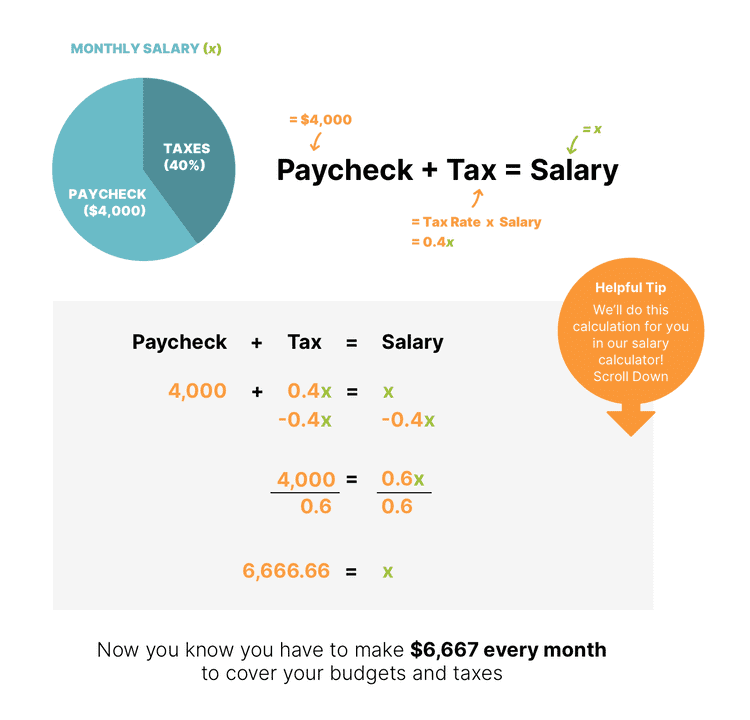

Here is a chart that illustrates the calculations we’re doing behind the scenes. Using this formula, you can determine your pre-tax salary from your post-tax paycheck needs.

3. Pay yourself that set amount every month — regardless of how much you made.

For example; if you need $5,000/mo to live, and you miraculously make $20,000 in a month; you should still only pay yourself $5,000! In this example, you would be able to pay yourself for almost four months (don’t forget about taxes!). That’s a massive increase for your runway, and it will help you prepare for the slower months ahead.

Assuming you are a full-time freelancer, you should already have both a personal and business bank account. If you do not have separate accounts, I strongly suggest opening one today. Keeping different accounts makes accounting much easier and more predictable — plus it makes tax time easy.

At the beginning of every month, give yourself a paycheck! I do this by transferring money from my business bank account to my personal bank account. If you’re feeling fancy, you could actually write out a paycheck.

Need help to figure out your freelance salary?

If you’re still confused or need help, try the simple calculator I’ve put together below. Just fill in your expenses, and it will break things down into simple, understandable terms. It will help you determine your expenses, estimated taxes, and what your salary needs to be as a full-time freelancer.

To cover your $0 monthly budget, you'll need to earn $0 every month, and you'll owe around $0 in taxes.

Monthly Paycheck

$0

Monthly Salary

$0

Yearly Salary

$0

Disclaimer: This tool is meant to help you get rough estimates. It should not be considered financial or tax advice. I am not an accountant, so if you need advanced help, please seek the advice of a certified professional.

Start focusing on the parts of freelancing you love

You probably started freelancing because you are passionate about the service you provide (and you’re probably great at it too!).

Once your finances are in check, you can get back to doing what you love; like delivering value to clients work working on projects you are passionate about. You’ll never have to worry about living invoice-to-invoice, working with clients who are not a good fit, or working crazy hours under high stress.

Take this one step further and figure out your runway. Your runway is the number of months you can pay your salary without needing to bring in extra income.

Once you know your runway, you’ll have a clear financial insight of: “you have six months before you need to find a new client.”

Read our other post 3 Reasons To Calculate Your Freelance Runway Today, and use our free runway calculator to help you determine your runway.

If you have questions or need help with any of these ideas, please reach out! I’m always interested in talking shop or learning about the challenges you’re facing as a freelancer. You can send me an email at jessica@tryhammock.com, or ping me via chat using the icon in the lower-left corner of this page.